| 作者 |

[分享]Munger Tells 25 Million Americans To "Suck It In", And [分享]Munger Tells 25 Million Americans To "Suck It In", And |

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

作者:theoretical 在 谈股论金 发贴, 来自【海归网】 http://www.haiguinet.com

To "Thank God For Bank Bailouts"

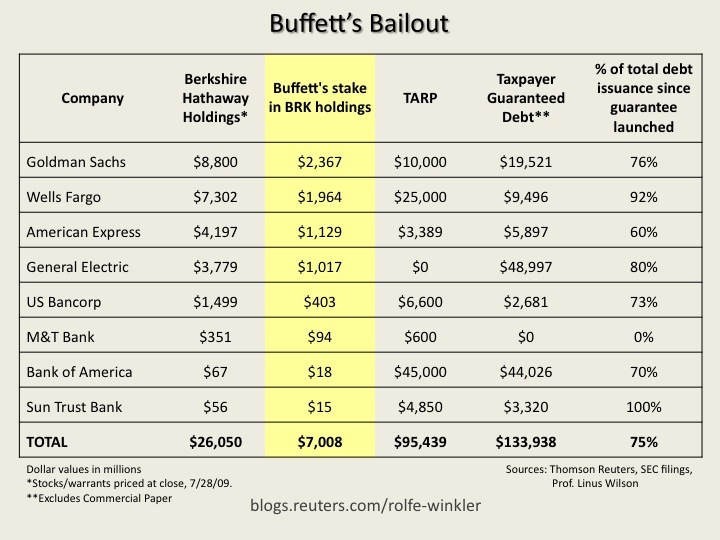

There is a reason why many countries institute mandatory retirement age: it is so that when dementia strikes, and people spout any damn thing that comes to mind, only the nearest four walls are subject to their insanity. Alas, when it comes to Berkshire Hathaway, no such luck. And while we have extensively discussed Warren Buffett's recent inexorable decline from merely a successful rider of the biggest cheap credit bubble in history to a captured puppet of Wall Street courtesy of his tens of billions of Wall Street-related investments, little has been said about his even older, and apparently even more affected by the unpleasant side-effects of a public televised senescence, sidekick, Charlie Munger. Luckily, courtesy of Bloomberg we now know just how deep the rot runs in the Berkshire family. During a discussion at the Universtiy fo Michigan, the 86 year old told the 25 million of Americans who comprise the 16.7% of the underemployed population in the country, to "suck it in and cope." Not only that, but apparently, all those who have been without a job for 99 weeks and more and no longer have recourse to insurance benefits, should "thank God for bank bailouts." Why of course he would say that: after all $26 billion worth of direct BRK investments were the recipient of over $95 billion in bailouts. So when it comes to him, thank god for the bailout indeed... But when it comes to the little man, old Charlie is all about doing the right thing.

It gets better:

Bank rescues allowed the U.S. to avoid what could have been an “awful” downturn and will help the country as it deals with the housing slump, Munger, 86, said. He used the example of post-World War I Germany to explain how the bailouts under Presidents George W. Bush and Barack Obama were “absolutely required to save your civilization.”

“Hit the economy with enough misery and enough disruption, destroy the currency, and God knows what happens,” Munger said. “So I think when you have troubles like that you shouldn’t be bitching about a little bailout. You should have been thinking it should have been bigger.”

Germany was unable to stabilize its financial system in the 1920s, and, Munger said, “We ended up with Adolf Hitler.”

Nowhere in Munger's ridiculous hypocritical ramblings does the old man mention that it was precisely the same currency debasement, wanton money printing and incipient hyperinflation that created Adolf Hitler out of the failed Keynesian experiment that was the Weimar Republic. Just as nowhere does he discuss his massive conflicts of interest that would have bankrupted the billionaire should the equity in banks have been wiped out, and Berkshire's holdings, together with its multi billions bet against the S&P, would have wiped out the firm, its shareholders and its management. Because lest we forget:

Munger slipped 16 places to 230th on Forbes magazine’s 2009 ranking of the wealthiest Americans as Berkshire’s stock gain last year trailed the advance in the Standard & Poor’s 500 Index. His stake in Berkshire, which didn’t take government aid, is worth about $1.6 billion.

As for how many of the companies that Berkshire has invested in did take government aid, well, that is an entirely different issue altogether.

We couldn't agree more with Joshua Rosner:

“Charlie Munger is misrepresenting history, and that’s why the public is angry at Wall Street,” said Joshua Rosner, an analyst at research firm Graham Fisher & Co. “We could have wiped out the equity holders before we wiped out the taxpayer.”

But of course, this would mean going back to the aforementioned conflict of interest, and Munger's apparent incomprehension that a business' operations can continue even as its balance sheet is being restructured. But Restructuring 101 is so simple and so logical, that we can see how that ten or so viable synapses in his head may have forgotten about it.

More on Munger's descent into dementia:

At the Michigan event, one questioner said he had attended both Berkshire and Wesco meetings. “You mean the groupies have followed me here?” Munger asked. To another who asked whether the government should have bailed out homeowners instead of Wall Street, Munger said: “You’ve got it exactly wrong.”

“There’s danger in just shoveling out money to people who say, ‘My life is a little harder than it used to be,’” Munger said at the event, which was moderated by CNBC’s Becky Quick. “At a certain place you’ve got to say to the people, ‘Suck it in and cope, buddy. Suck it in and cope.’”

When one hears hypocrisy like that, what can one say but - Charlie Munger. Of course, when financial organizations, and complete bankrupt states comes begging for money to their respective central banks, as is the case each and every day in Europe, and soon among the various broke states in the US, not to mention thousands of pension funds, sucking it in is such an anathema. Or at least it would be to people like Munger and Buffett, who have invested their entire life savings in the perpetuation of a regime that will eventually result in the same social upheaval if not outright global conflict, that Munger laments caused WW2.

Luckily for him, he won't be around to see it.

300 million other Americans, however, won't have the same privilege.

For those who wish to projectile vomit at their monitors, here are two straight hours of unbridled hypocrisy.

作者:theoretical 在 谈股论金 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

|

-

[分享]Munger Tells 25 Million Americans To "Suck It In", And -- theoretical - (5640 Byte) 2010-9-22 周三, 02:11 (1276 reads) [分享]Munger Tells 25 Million Americans To "Suck It In", And -- theoretical - (5640 Byte) 2010-9-22 周三, 02:11 (1276 reads)

|

|

|

|

您不能在本论坛发表新主题, 不能回复主题, 不能编辑自己的文章, 不能删除自己的文章, 不能发表投票, 您 不可以 发表活动帖子在本论坛, 不能添加附件可以下载文件, |

|

|